[HOW TO] Create a great trading setup

Table of Contents

I've been creating, backtesting and forwardtesting a lot of trading setups these past few months, i tend to follow the same process every time and it has helped me get interesting results

In this article i'm going through all the steps with an actual example

1. Creating a great setup

First things first, you need to know what is

a great trading setup. Understanding the end

goal will help during the process.

I usually go through an iterative process,

starting with an initial idea, it might be a

specific event in the market, or some market

conditions i'd like to study and then i try

to progressively refine my initial idea

until i get something that looks good.

By something that looks good, i mean a setup

where's something you can predict in a

reliable way. When price does X, then price

does Y

But you also need to take into account a few

other parameters, as predicting price path

isn't always enough. These parameters would

be the.

- Risk/Reward: Is the move gonna be significant enough (for the risk i take)

- Win rate: What's the probability of a winning trade

- Profit: what's the expected value given the RR and the win rate

1.1 What is a great setup

Obviously enough, a good setup is a setup that makes money... but it's a bit more complicated, in the end the best setups are the ones that:

- Maximize profits: you need to make money

- Minimize risks: you don't want to lose 90% of your money before earning something

- Generalize well: setups that maintain their test performance in live trading conditions

Designing a good setup/strategy is always a balance between maximizing profits and minimizing risks.

You also need to take into account randomness and reproducibility, meaning you need to find setups that perform well in your tests but also have a good chance at performing well in the future

1.1.1 Returns, risk, win rate, drawdown, sharpe ratio

There's different ways to measure a strategy's returns. You can use the ROI, ROE or ROA

- ROI: Return on Investment: basically it's the return of the trade. If price moves 10%, it's a 10% ROI

- ROE: Return on Equity: it's the profit relative to the amount you put in to the trade. This measure takes into account the leverage you're using

- ROA: Return on Assets: it's the profit computed taking into account your whole balance. This measure takes into account the leverage and risk management

There's different ways to measure a strategy's profits. You can use the ROI, ROE or ROA

Risk

The most important thing to realize here

is that your strategy will go through

consecutive losses. The higher risk you

take, the higher chances you get

liquidated, the higher returns you need

after a draw down to get back in profits

The risk parameters depends on your

setup performance. A setup with a 90%

win rate and a setup with a 30% win rate

don't have the same risk profile. With a

higher win rate, there's more

probability you won't go through many

consecutive losing trades, meaning you

can risk more on each trade.

I usually backtest with a 1% risk, it's

a rule commonly used. Backtesting can

help you refine this parameter.

Win Rate is another piece of the puzzle.

People tend to think it's better to have

a high win rate strategy but it's not

that simple

Obviously, winning each trade sounds

good in theory. In practice, there's no

free lunch, there's a trade off between

win rate and returns: High win rate

strategies usually don't yield high

returns per trade, and high returns per

trade strategies usually don't have

great win rates.

Important thing to remember: high win

rate means less risk, less consecutive

losses and less drawdown. Lower win rate

strategies mean higher risk of large

drawdown, and need to generate more

returns per trade.

Low win rates strategies need more

samples to make sure the strategy is

repeatable and not just a random fluke.

High win rate strategies can provide

more statistical significance

1.2 initial idea

When trying to find new setups, i like to either start with a specific market event, say a big candle with high volume, or with some market conditions, a range for example, and then try to find some patterns that repeat.

1.2.1 important market elements, events & phases

Here's a list of things that can make for a good starting point

Market Events:- high / lows

- market structure

- support/resistance levels

- FVG, Poc, nPoc

- large candle or high volume

- compression, expansion

- break, sweep, deviation, retest of market elements

- range/consolidation

- trend up / down

Obviously enough, the goal is to find an edge, meaning you need to find some patterns of price action that keep repeating so that next time it happens, you know how to trade it

I usually start by creating a very basic setup with my initial idea, i run a test and then i just look at the chart to make some observations that will help refining the idea

[EXAMPLE]

Here's an example where i'm gonna try to

find something interesting by looking at

resistances

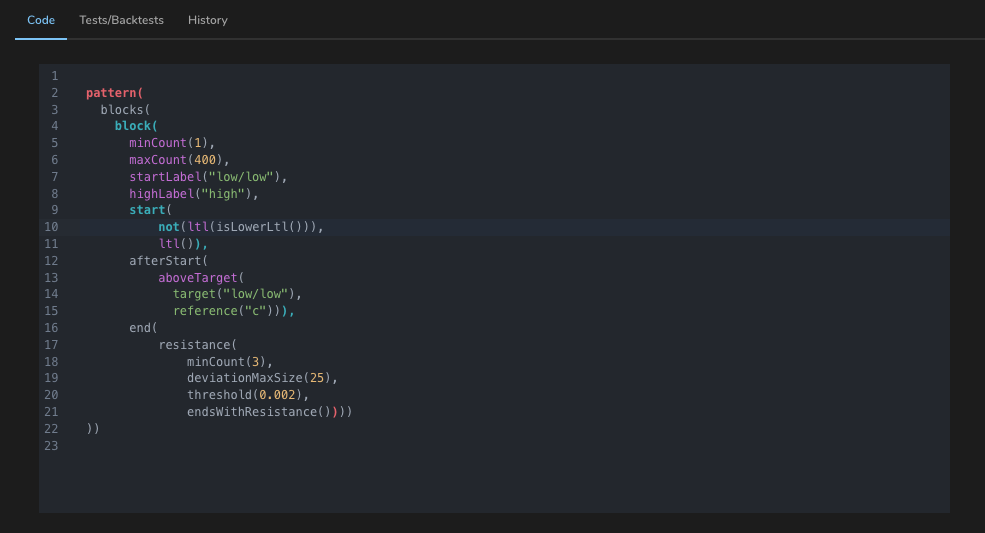

I'm starting with resistances with at

least 3 highs.

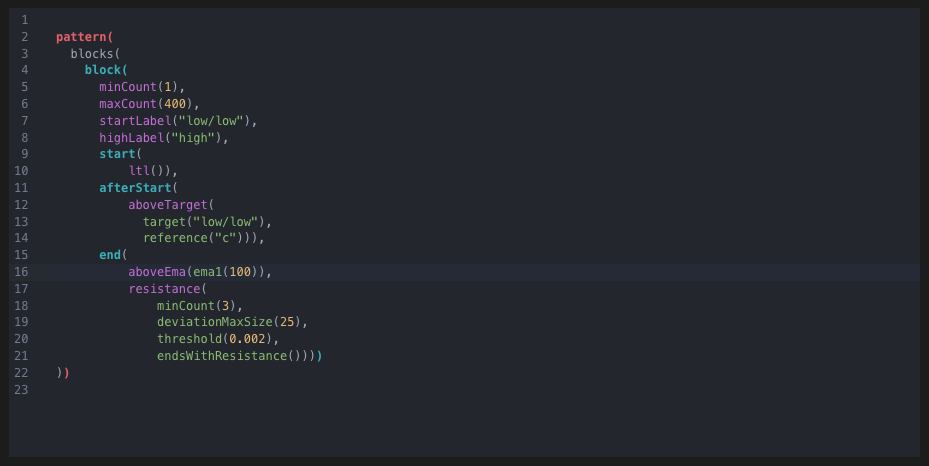

Here's what the code looks like

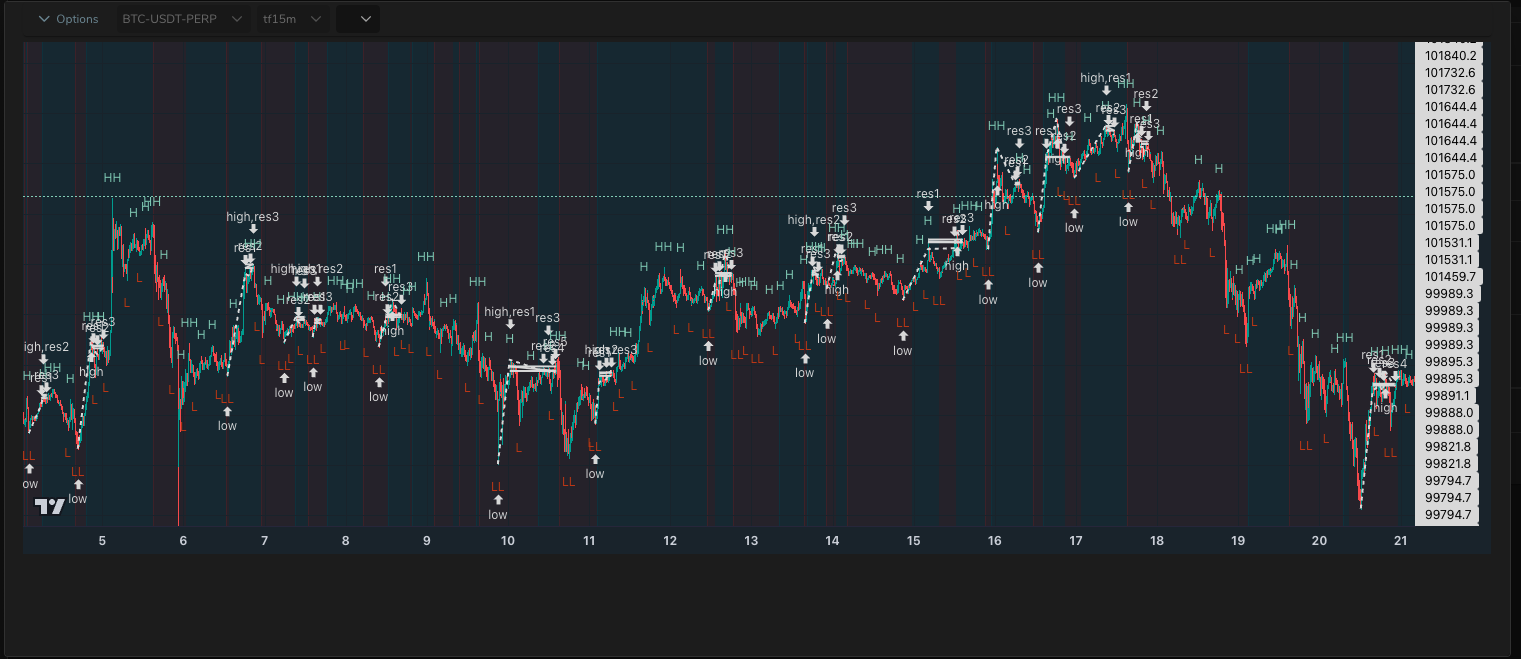

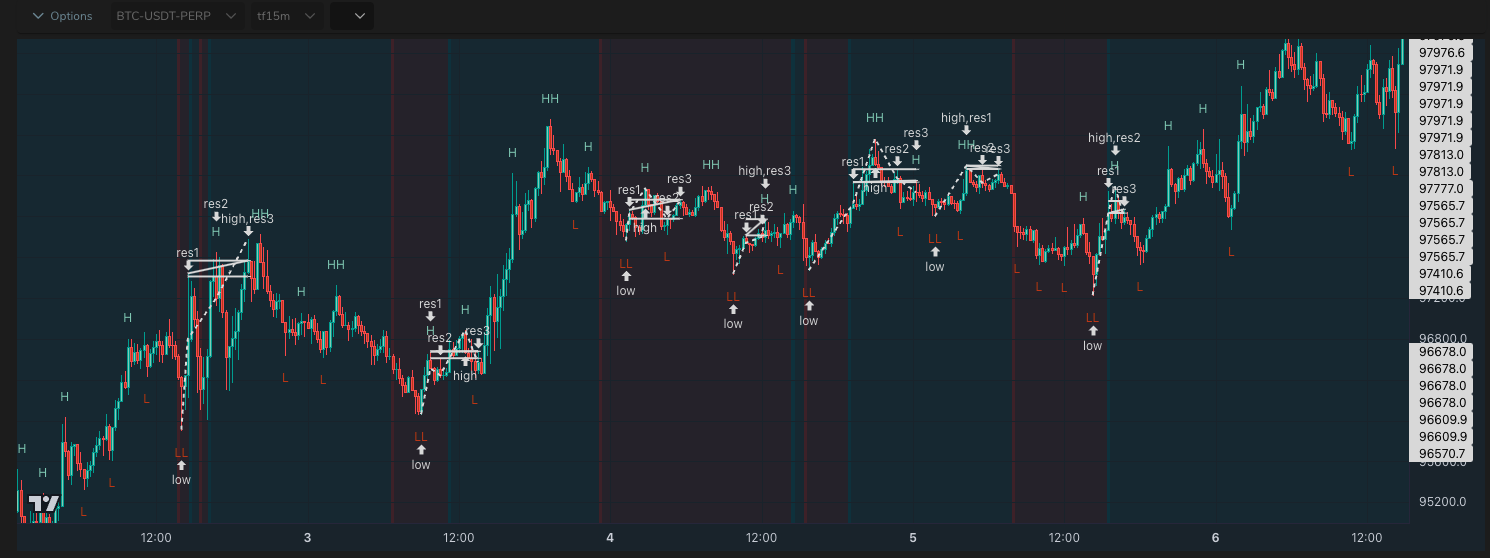

Here's the results on BTC/USDT, 15m timeframe

1.3 iterative process: test & refine idea

Now the goal is to build upon this first idea and iteratively tweak the setup to get the best result.

When you're creating a setup, you usually test your idea over a few months' worth of data. Obviously you won't be able to see all the occurrences so you need to build the strongest setup possible.

One thing to keep in mind, is that you're gonna need a minimum number of samples for your backtest. The more samples, the more confidence you'll have in your backtests.

That means you can't be too restrictive when tweaking your setups, you still need to find a minimum number of occurrences.

Keeping that in mind, i usually try first to get rid of the setups that don't fit my setup. If i'm trying to build short at resistance zones, i'm gonna need to filter the setups that don't lead to a dump.

Then you can either try to optimize the Risk/Reward or the win rate. There's no free lunch, and optimizing for both is like trying to find a unicorn

Trying to optimize the win rate usually means you're taking less risk, which means you're probably trying to get less profit per trade. That probably translates into a wider stop loss for example.

Trying to optimize the risk/reward means you're looking for big trades or trades with tight stop losses. When you using tight stop losses, you obviously gonna hit these SL more often, that will lower your win rate. The goal here to make large profits when your trade is a win.

- Is there a pattern that keeps repeating every time ? price goes up or price goes down, or price retests then goes ...

- Should i try to tweak the parameters to exclude some occurences that don't seem to fit ? maybe look at resistances with more points, candles with higher volumes ...

- Should i try to study these events in some specific contexts only ? study the event when it happens after a pump, after a dump, during a consolidation...

1.3.1 tweak parameters / add conditions

Refining the idea basically means trying

to optimize one or more parameters.

You can try to get a better RR, a better

win rate, more samples ...

[EXAMPLE]

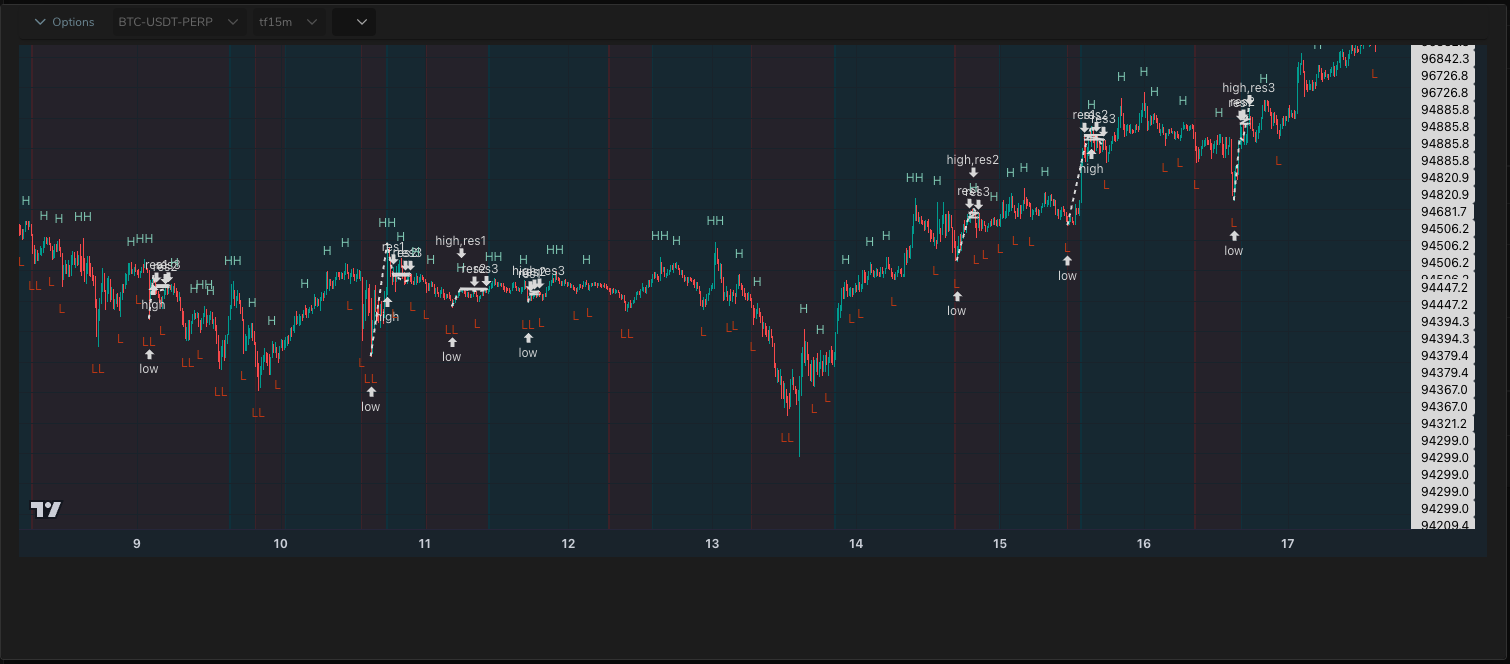

Looking at the previous results, a few observations:

- To be honest, this doesn't look bad for a first draft.

- This setups tends to happen either after a bottom, when price is consolidating below a resistance, or after a move up when price struggles to keep the momentum up

- Price moves dump when this setup occurs after a significant move up, sometimes right away, sometimes there's a move down before a retest setting the stage for a bigger move down

Optimization ideas

- Get rid of setups at the bottoms. I could try to use EMAs to check if it's more likely to be at a bottom or a top

- handle retests or create two setups, one for the immediate dump and another one to handle the retest

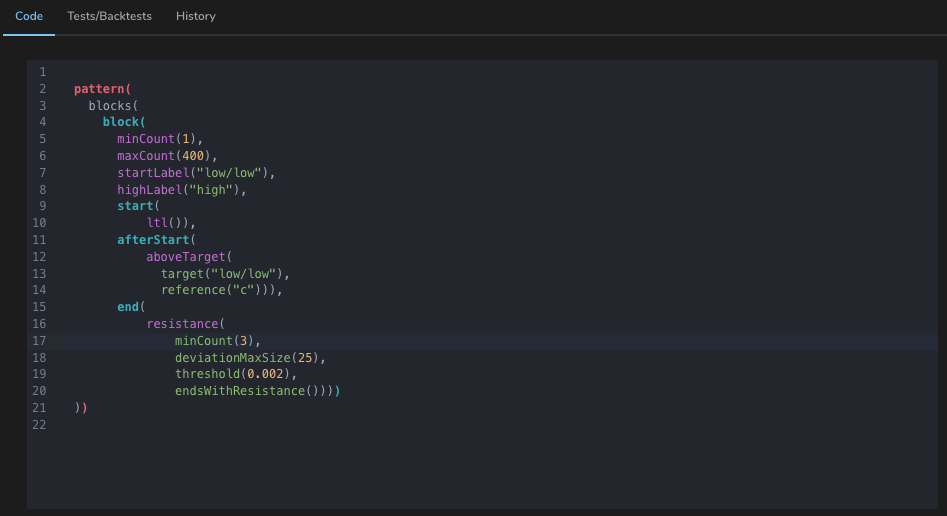

To avoid setups at the bottoms,

i'm trying to exclude setups

that start on a lower LTL. These

lower LTLs would probably mostly

be found at the bottoms

This code could do the trick: not(ltl(isLowerLtl()))

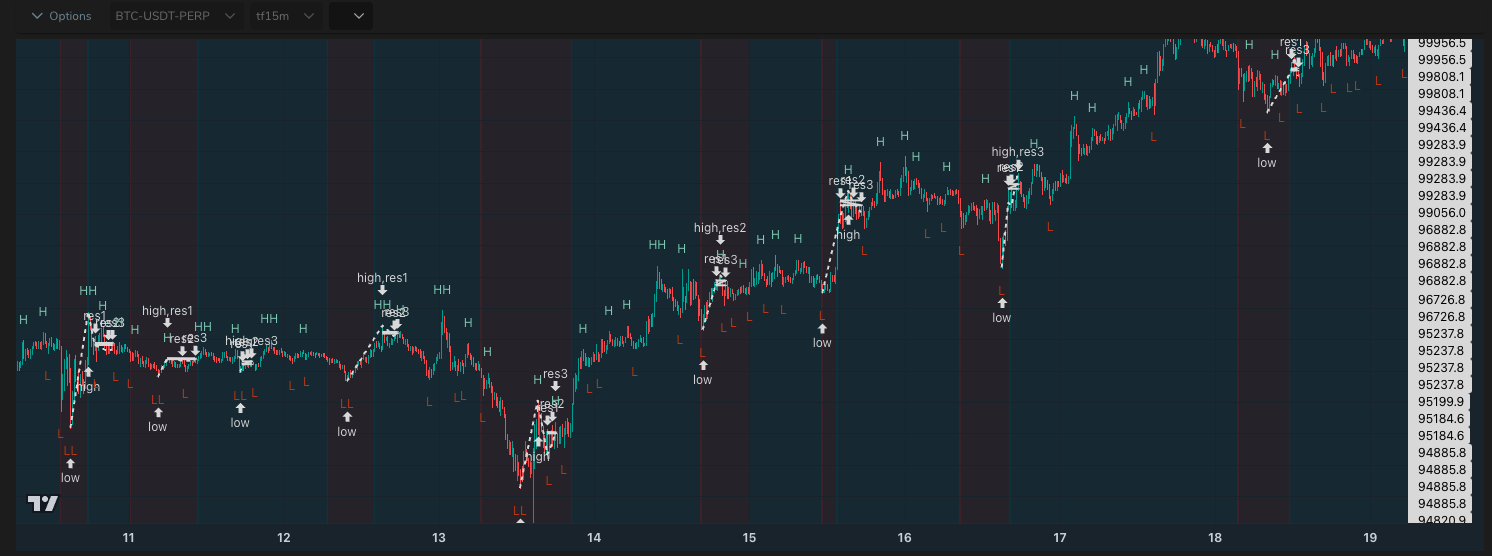

This trick seems to be working, the setup between the 13th and 14th is excluded now for example. That might not be optimal as it could other valid setups but this seems good enough for now

I also tried to filter the setups based on an EMA condition, for example, i only keep the setups where the price ends up > EMA 100: aboveEma(ema1(100))